Virginia FHA Funds Provide the Secrets to Homeownership

To purchase property is an aspiration for most, but it can feel unrealistic, particularly if you are a first-day homebuyer. While navigating the new housing marketplace, you have most likely been aware of FHA home loans. Brand new FHA home loan will still be the most famous a mortgage option for first-time buyers during the Virginia.

The application form was designed to make homeownership even more obtainable by offering restricted down payment standards. This might be especially helpful in more expensive homes towns and cities for example city DC where the median household price currently exceeds $610,000. But how do FHA money works, and they are it ideal fit for you? Let’s falter all you need to learn.

What exactly is an FHA Loan?

A keen FHA financial are a government supported home loan on Government Construction Government (FHA) and you can given thanks to recognized loan providers and banking companies. The application is a well known among first-date homeowners considering the straight down credit rating and advance payment standards than the traditional financing. FHA finance try to make homeownership cheaper, particularly for those who will most likely not qualify for traditional mortgages.

Together with buy money, FHA offers diverse refinance alternatives for most recent people interested in lose their interest rate, otherwise cash-out guarantee getting renovations or debt consolidation.

As to the reasons FHA Money are Popular One of Virginia Earliest-Time People?

First-time homebuyers tend to deal with numerous demands off saving for a downpayment in order to securing a loan with less-than-finest borrowing. FHA funds address these issues myself, this is the reason these are typically popular. This new flexible degree standards and you will easy words create more comfortable for more individuals to go into new housing market.

Benefits of FHA Fund:

There are some benefits to going for an enthusiastic FHA loan, particularly for basic-date homebuyers. Listed below are some of your own key masters:

- All the way down Credit rating Criteria In the place of antique financing, which may wanted a credit history from 640 or more, FHA loans is commonly accepted with score only 580.

- ol]:!pt-0 [&>ol]:!pb-0 [&>ul]:!pt-0 [&>ul]:!pb-0″ value=”2″>Quicker Down-payment Probably one of the most appealing aspects of FHA finance ‘s the low down percentage criteria. You can safer financing having as low as 3.5% off plus 100% money can be done having acknowledged downpayment guidelines.

- ol]:!pt-0 [&>ol]:!pb-0 [&>ul]:!pt-0 [&>ul]:!pb-0″ value=”3″>Flexible Qualification Conditions FHA finance are created to make homeownership offered to more people. This means a lot more flexible money and you can obligations-to-income percentages without reserve standards.

Drawbacks from FHA Loans:

When you’re FHA financing promote several advantages, nevertheless they include some drawbacks. It’s vital to look out for these before you make your choice:

- ol]:!pt-0 [&>ol]:!pb-0 [&>ul]:!pt-0 [&>ul]:!pb-0″ value=”1″>Mortgage Insurance premiums (MIP) FHA funds need both an upfront and you can annual (monthly) financial top, that add to the total cost of your mortgage. But not, a lot of authorities and you may antique home loans require it if downpayment is actually less than 20%.

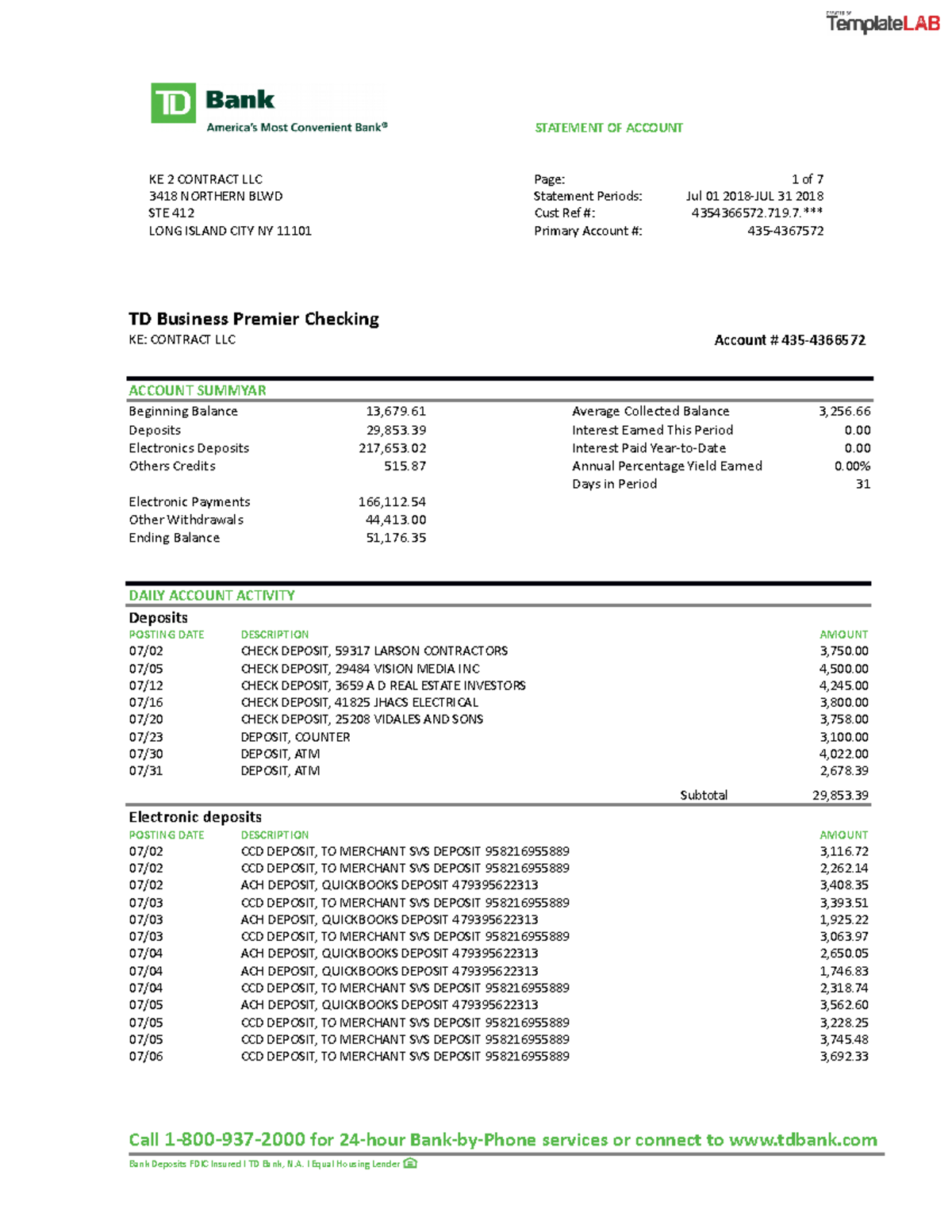

- ol]:!pt-0 [&>ol]:!pb-0 [&>ul]:!pt-0 [&>ul]:!pb-0″ value=”2″>FHA Financing Limitations The fresh programs keeps mortgage limitations you to definitely differ of the part. This might be a restriction if you’re looking to buy good more costly household. The mortgage constraints initiate from the $498,257, however, many of one’s high-rates counties doing DC instance Arlington and Fairfax, provides greater mortgage constraints around $1,149,825. Please select the state by condition Virginia FHA financing constraints detailed about graph less than.

- ol]:!pt-0 [&>ol]:!pb-0 [&>ul]:!pt-0 [&>ul]:!pb-0″ value=”3″>Possessions Standards The house or property you may be to acquire have to see particular HUD requirements place by the the latest FHA, that can limit your cash advance payday loans Gilcrest CO solutions. Certain condos must also has actually an alternative FHA approval designation.

Understanding Mortgage Insurance coverage

One of many unique areas of FHA finance ‘s the criteria to possess home loan insurance rates. There are 2 section to that:

Leave a Reply

Want to join the discussion?Feel free to contribute!