7 Details about FHA Multifamily Fund to have Reasonable Construction

The latest Government Property Administration (FHA), part of the U.S. Agencies of Homes and you will Urban Development (HUD), is amongst the prominent home loan insurance vendors international. The agencies secures mortgage loans toward affordable property, multifamily attributes, single-friends belongings, and you can medical care facilities. As the 1934, FHA has financed more than fifty,000 multifamily mortgages nationwide. Whether you are interested in getting, refinancing, otherwise rehabilitating an easily affordable houses assets, FHA multifamily financing is a funds route you must know from the.

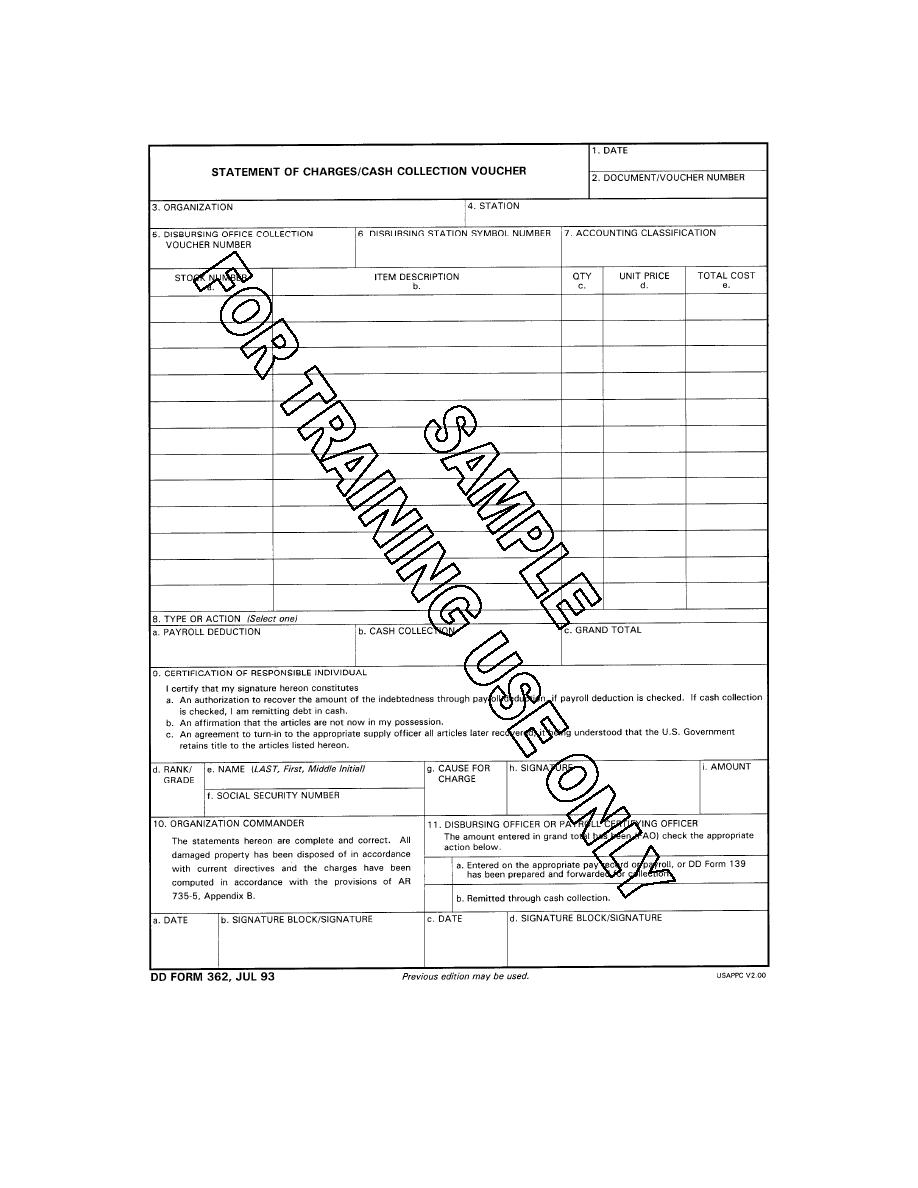

FHA loans give significant benefits into manufacturing and you can maintenance regarding reasonable construction properties, plus large LTV allowances, less DSCR criteria, and lower mortgage insurance premiums

- What’s an FHA Multifamily Loan?

In partnership with subscribed lenders eg Arbor, HUD and you will FHA insurance rates software make resource offered to traders to own brand new treatment, advancement, and you can refinancing of the many flat functions to make reasonable and you will lower-money property so much more accessible to all of bad credit personal loans Delaware the Americans.

FHA money offer extreme positives into manufacturing and you may maintenance off affordable homes properties, along with higher LTV allowances, fewer DSCR standards, minimizing home loan insurance costs

- What kinds of Properties Qualify?

This new Government Homes Administration represent multifamily characteristics due to the fact people who have a lot more than just four equipment. It does tend to be blended-play with area provided that at the least 51% of your total square video footage is actually residential. Affordable housing generally describes those services where in actuality the tenant is actually expenses just about 30% off revenues getting property will set you back, in addition to resources.

FHA financing promote significant masters on the development and you will conservation from affordable property properties, as well as high LTV allowances, fewer DSCR criteria, minimizing home loan insurance costs

- Just how can FHA Funds Performs?

FHA guarantees loans unlike privately making them. Their fund shelter an entire spectrum of ily services and you will affordable housing ideas, as well as reasonable-earnings construction and leasing direction.

Multifamily Accelerated Operating (MAP), a streamlined means and place off federal conditions to possess recognized loan providers to set up, procedure, and you will complete applications having HUD multifamily resource, is required getting FHA loans. Accepted FHA Chart loan providers such Arbor promote the means to access flexible FHA multifamily financing software to the an expedited foundation and you can resource to own acquisitions, refinancing, moderate rehabilitation, large treatment, or this new build.

FHA money offer tall pros with the creation and preservation off affordable property features, in addition to higher LTV allowances, a lot fewer DSCR standards, and lower financial insurance premiums

- Exactly what Advantages Would FHA Financing to possess Affordable Construction Features?

- Low-down repayments

- Long amortizations having reasonable monthly obligations

- Versatile debt solution publicity percentages (DSCR)

- Low interest

On top of that, Arbor borrowers could probably recoup guarantee as an element of refinancing and work out monthly withdrawals away from extra cash on certified FHA multifamily loans.

FHA fund offer tall pros on the design and you may maintenance from sensible construction attributes, together with large LTV allowances, a lot fewer DSCR criteria, and lower home loan insurance costs

- What types of FHA Financing Are used for Sensible Casing?

FHA affordable houses financing items are tend to used for the fresh design and maintenance from reasonable homes. They often times has flexible loan terms and conditions and repaired- or adjustable-rates choices.

While FHA multifamily finance aren’t substantially different from Federal national mortgage association otherwise Freddie Mac computer loans, you will find some nuanced criteria one consumers should be aware of:

The Funding Partner Will be here to respond to Your Concerns During the Arbor, matchmaking are the foundation of our providers, and you will we have been invested in taking first-category solution. While the a top 20 FHA Financial into the fourth year in the a row inside 2022, Arbor features good relationships which have HUD organizations nationwide and you will makes use of better-in-class 3rd-class dealers. We have the options and you can dedication to book our very own subscribers owing to the complete loan process, and you will we work along with you to customize the proper financing service to meet your needs.

Looking the fresh multifamily owning a home markets? Contact Arbor right now to realize about all of our assortment of multifamily, single-family local rental, and you will affordable housing financial support choice otherwise glance at our multifamily articles and look records.

Leave a Reply

Want to join the discussion?Feel free to contribute!