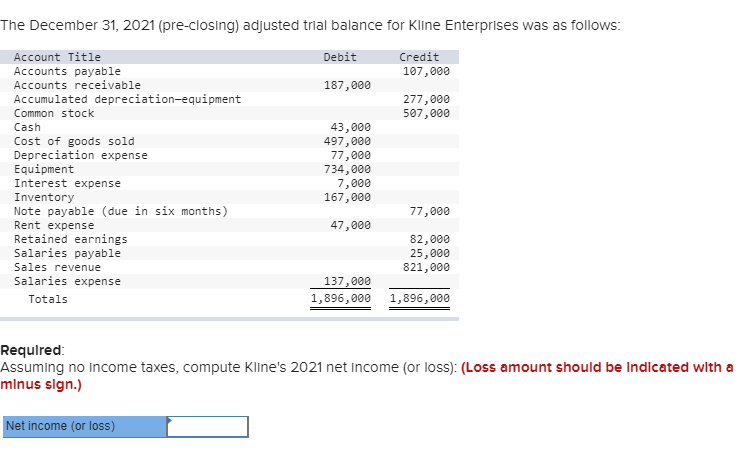

Unsecured loans is repaired-price loans with words between 12 so you can 60 days

For those who individual your residence, you might be guilty of keeping the status, and can place a strain on your purse. As a result of this, really it is suggested keeping step one% of the house’s value, otherwise $step 1 per sq ft, into the a savings account to greatly help security repairs. Homeowners insurance simply talks about specific danger, when you crack the sink or your homes roof should be replaced because of many years, you are towards the connect towards the cost. And house solutions are going to be expensive. From inside the 2022, the typical family relations spent $3,018 toward domestic maintenance will cost you.

You happen to be capable cover minor repairs from your own emergency discounts, but what if you need to alter your heater otherwise resolve your foundation (both of which can costs several thousand dollars)? If you’re not yes tips pay money for an essential domestic resolve, borrowing from the bank money was an alternative.

Just what are house repair finance?

If you want assist financial support an upkeep for your house, you may use a property repair financing, which is an umbrella name for any version of loan made use of to pay for house fixes. Each type of home fix mortgage includes its own positives and you will drawbacks, and many are simpler to be eligible for than others. The most suitable choice also depend on personal items, like your credit score and the matter you ought to obtain.

Personal loans

According to the financial, you can generally speaking obtain any where from $1,000 so you can $fifty,000 or more, and because the cash are used for any goal, you should have flexibility which have the method that you spend it. This might be of good use if you would like combine personal debt from the once you have to pay for your home fix, such as for example. Additional major advantage of personal loans is the fact that money try granted rapidly, constantly within a matter of weeks.

Extremely unsecured loans is unsecured, definition they won’t need equity, but it is you are able to to track down a personal bank loan secured by the car. Talking about known as vehicles guarantee loans and regularly incorporate lower rates of interest than just unsecured unsecured loans, especially if you provides reasonable credit. Just as in very financing, a reduced rates is actually kepted for the most creditworthy borrowers, but it is in addition to you’ll be able to to acquire a zero-credit-view consumer loan, often known as a repayment mortgage. Such incorporate greater costs, but on one helps you make borrowing so you’re able to has actually best borrowing from the bank options in the future.

Really loan providers provides an effective prequalification process that enables you to see their price instead harming the borrowing, in order to compare selection from some other loan providers. Make sure you take note of the origination commission, that will be taken out of the income you will get, together with apr (APR), and this is short for the full price of borrowing. If you can, end unsecured loans that have prepayment punishment.

Domestic equity financing

Property equity financing is an effective way to tap this new collateral you really have of your property. Essentially, you are credit straight back a percentage (constantly as much as 85%) out of everything you currently reduced via your mortgage repayments. Including an unsecured loan, you will get a lump sum payment which have a predetermined interest, and you may conditions normally past 5 to help you 15 years. If you are using the bucks and make a meaningful improvement, such as for example substitution the Cooling and heating system, in lieu of a regular fix, the interest tends to be taxation-deductible.

The newest downside is you will pay closing costs same as you did with your home loan, that is run up to 5% of the pay day loans in La Fayette AL dominating. The interest will be greater than the pace in your first-mortgage. At exactly the same time, given that property security mortgage was protected by your domestic, when you are unable to keep up with the mortgage payments, your exposure foreclosures.

Leave a Reply

Want to join the discussion?Feel free to contribute!