Were there choices in order to family resolve money?

Very options for domestic repair financing are generally secured, which means that discover a threat you might beat your house, otherwise merely give low costs to people which have a good credit score. Just like the credit might be risky and you can pricey, you must know other options prior to taking away a house resolve loan. In case your fix isn’t immediate, believe reevaluating your finances to keep more cash rather than borrowing. If it’s an emergency, envision asking household members or members of the family to possess let; it more than likely wouldn’t ask you for high rates of interest and will feel significantly more flexible with installment. You might like to think one of the pursuing the choices:

Cash-aside refinance

Cash-away refinancing enables you to replace your latest financial that have a beneficial larger mortgage and keep the difference just like the cash. Of the enhancing the dominating, you will have a high payment per month, but you’ll discover a lump sum that you can place to your necessary solutions. The lump sum payment is usually no more than 80% of the home’s readily available security. It may be it is possible to locate a lesser rate of interest whenever you re-finance, but you’ll shell out closing costs when you’re which channel.

Contrary financial

A contrary home loan try a way getting home owners decades 62 and older to help you borrow on the brand new equity within land. It is a good option for an individual that currently paid the home loan and desires receive repayments throughout the financial for household solutions. You’ll shell out settlement costs and possibly also financial insurance costs, but you will not have to pay-off the loan if you do not promote your house otherwise perish, and not need to pay taxes on the money you receive.

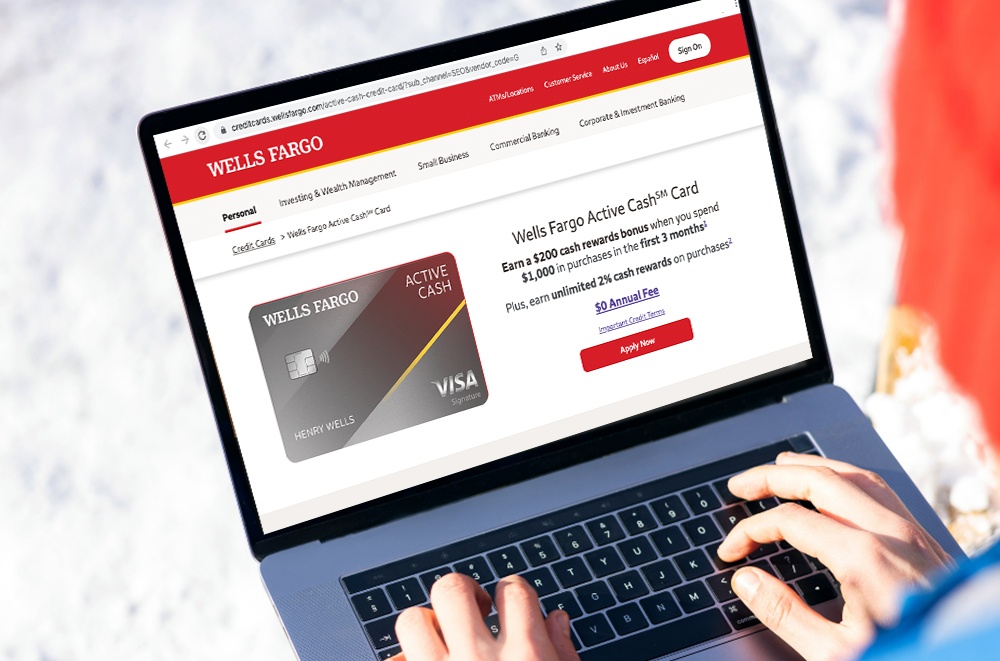

Credit cards

If you have a good credit score, it’s also possible to qualify for a charge card with a beneficial 0% introductory Annual percentage rate, and is helpful for funding lesser solutions and this can be paid down within the attract-100 % free several months. Typically, you could potentially end appeal having twelve so you’re able to 18 months with these cards. To own a bigger repair that you need to repay over big date, you’ll likely be better of that have a personal bank loan. That is because as the introductory several months ends up, the average credit card , because the average Annual percentage rate for the a personal bank loan concerns %.

HUD advice apps

On occasion, low-earnings homeowners is qualified to receive features or attract-100 % free money on the Agency of Construction and you will Urban Invention. Determine https://paydayloanalabama.com/elba/ whenever you are qualified to receive regional do it yourself apps before you could comparison shop to have home fix finance.

How to plan future fixes

Household solutions is actually inevitable, additionally the most practical way to prepare towards bills is to keep a totally-stocked crisis fund. You’ll have your homeowner’s tax deductible number saved in introduction in order to dollars for noncovered solutions. Positives basically strongly recommend protecting 1% of your own residence’s worthy of to possess unexpected solutions, but when you understand fixes which will be expected within the the near future, you should initiate protecting today. Be mindful of the life span of your devices or any other attributes of your property to feel economically prepared.

Take note the below article contains hyperlinks to help you external websites outside out of OppU and you may Options Financial, LLC. Such supplies, if you are vetted, aren’t associated with OppU. If you simply click any of the links you will be delivered to an external website with various fine print you to definitely may vary from OppU’s rules. We recommend you will do your search in advance of engaging in people products or services listed below. OppU isnt a topic count specialist, nor does it guess obligations if you opt to engage these products or services.

Leave a Reply

Want to join the discussion?Feel free to contribute!