Reduced Credit? Get FHA 203k Loan That have Lower than 600 Credit scores

Thinking from flipping that fixer-higher into your fantasy domestic however, concerned your credit rating is not up to par? You aren’t alone. Many homebuyers have been in an equivalent motorboat, questioning if they safe an enthusiastic FHA 203k mortgage which have significantly less than 600 credit scores. What’s promising? It is possible, and we have been here to help you each step of one’s ways.

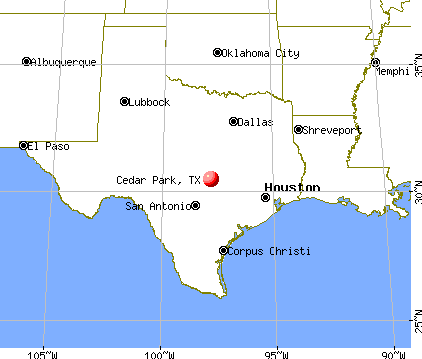

From the Gustan Cho Couples, we concentrate on enabling buyers with lowest fico scores get the financing they must get and you may remodel belongings. Why don’t we plunge toward the way to qualify for an enthusiastic FHA 203k mortgage, even though your credit score try less than perfect.

What’s an enthusiastic FHA 203k Loan?

Imagine you have located a great fixer-higher, a house which have great skeleton however, wanting certain really serious love and you may care and attention. Generally speaking, you’ll check a few independent stress: you to definitely loan to buy the spot and one to resolve it upwards. And here an enthusiastic FHA 203k loan comes into play. Consider it as a single-end go shopping for to order and restoring your perfect house. You can roll the acquisition and you may renovation can cost you with the one to. It is such as taking a house tailored with the liking without any problems out-of speaking about numerous fund and you will closing processes.

Let’s cam currency, specifically for men and women watching your own costs closely. Which have an FHA $255 payday loans online same day Washington 203k financing, you don’t need an enormous bunch of cash initial. Alternatively, you only need to add only step three.5% of one’s residence’s value following upgrades. This is a game title-changer if you’re not sitting on a huge stash out-of offers.

And you may here’s the kicker for anyone worried about their credit score: FHA 203k finance is awesome friendly when it comes to borrowing records. Even if your credit score are significantly less than 600, and this, let’s not pretend, is lower than of several financing perform demand, there clearly was however a route give for your requirements. Some lenders, eg Gustan Cho Partners, is entirely okay with money an enthusiastic FHA 203k financing that have below 600 credit scores. So, never number your self away if your borrowing from the bank isn’t really gleaming. This mortgage makes you get and reond in the crude.

Can you Rating an FHA 203k Loan Having Significantly less than 600 Borrowing Results?

Contemplating bringing a keen FHA 203k loan having below 600 borrowing ratings? You are in luck because it is without a doubt it is possible to. The folks from the FHA is actually flexible in the fico scores, that’s great for many people. However, snagging one among them financing that have scores lower than 600 might take a bit more work.

Bank Overlays

So even in the event FHA says it’s chill which have fico scores doing during the five hundred if you’ve got a great 10% deposit, many banks or mortgage towns and cities need lay their legislation, making it some time harder. They could not require to visit lower than 580. However, hi, metropolises eg Gustan Cho Couples are only concerned with enabling those with score below 600.

Tips guide Underwriting

If you find yourself regarding under-620 bar, your own documents may get a closer look thanks to things titled guidelines underwriting. This is certainly a love technique for saying financing expert will just take a-deep diving into the money situation, work records, and you will people pluses you really have that make up to the lower rating.

Why FHA 203k Loans are great for Reasonable Borrowing Consumers

Envision you discover a good fixer-higher, your credit score was below 600. You are probably convinced the choices was restricted, right? This is when the latest FHA 203k mortgage steps in, and it’s rather super for people eg you. Let us crack they down:

- Redesign and construct Guarantee: Earliest, a keen FHA 203k loan feels like hitting one or two wild birds having that stone. You’re able to buy the household and also have the bucks in order to repair it. It means you’re making the place more vital and you can stacking right up guarantee away from day you to definitely. And you can who doesn’t love viewing its funding expand?

Leave a Reply

Want to join the discussion?Feel free to contribute!