Secure Ties: An alternative way to fund Domestic Mortgage loans

Like the today authorities-owned Fannie mae and you can Freddie Mac, large resource finance companies aided manage funds to invest in this new mortgage loans from the issuing ties supported by swimming pools from established mortgage loans. However, private firms have abandoned these types of tool, in accordance with them a big source of home loan financing has vanished. Four higher money banks decide to would an alternative U.S. marketplace for a classic software, hoping to provide liquidity to the mortgage business.

This new views writers show in Financial Comments is theirs and never fundamentally those of the fresh Federal Set aside Bank away from Cleveland or even the Panel of Governors of the Federal Set aside Program. The collection editor was Tasia Hane. That it report and its own analysis was susceptible to update; please go to to have status.

Until the june away from 2007, mortgage brokers increasingly tapped funding areas getting quick and you may inexpensive resource. Due to a method named securitization, they might offer this new financing they had got its start to your authorities-paid organizations (GSEs) Federal national mortgage association and you will Freddie Mac, or even to higher funding banking institutions, which then packaged these types of finance towards the various securities and ended up selling all of them in order to traders. Loan providers utilized the marketing continues and make the fresh finance, that have been plus delivered from the exact same securitization process.

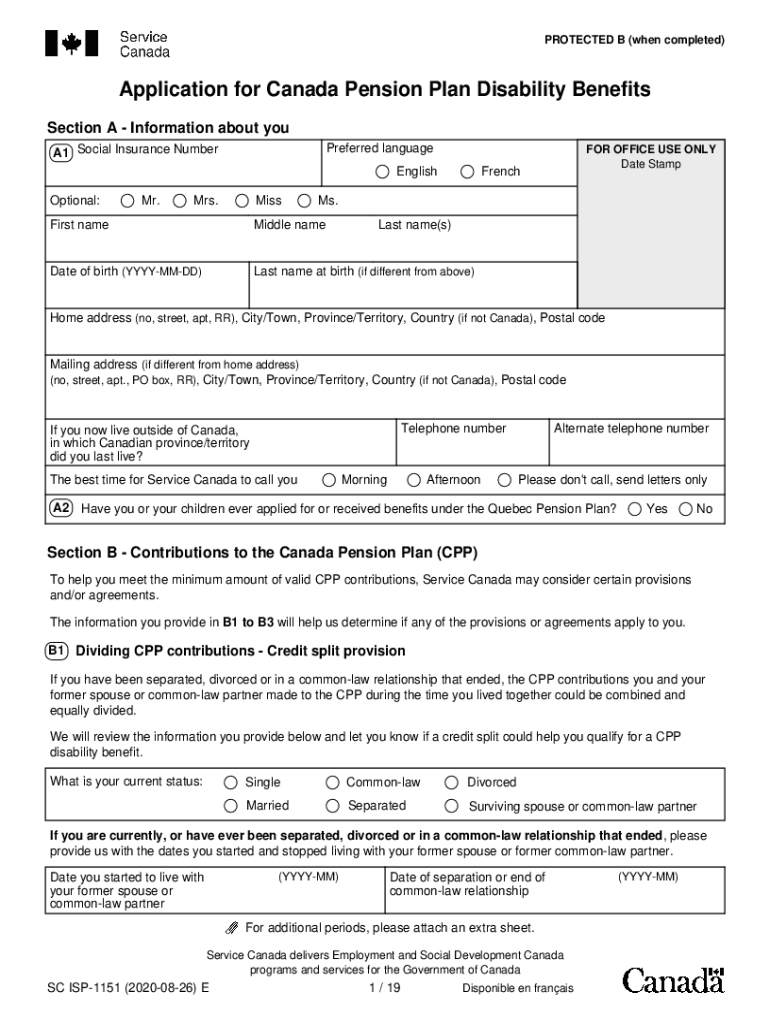

Since credit market disorder started, although not, it supply of funding try faster easier and plentiful than they was once. While you are lenders can invariably offer perfect mortgage loans smaller than as much as $417,000 to Fannie and you will Freddie (the maximum utilizes the location), you to phase of your securitization market has actually essentially disappeared: High investment banking companies has actually eliminated issuing the financial-supported bonds and they are not any longer to buy mortgages so you’re able to repackage for you to definitely objective. So it source of investment up until now constituted a beneficial trillion cash (pick profile step 1) and you may was used mostly of the loan providers you to produced subprime financing and finance bigger than $417,000. Their disappearance comes with the potential to then disturb borrowing circulates and you will damage the new ailing housing marketplace.

Contour step 1. Home loan Originations because of the Way to obtain Capital

Regardless of this problem from the mortgage-recognized securitization business, the latest money supply try emerging. In July of the year, five higher resource banking companies-Bank regarding The united states,Citigroup, JPMorgan Pursue, and Wells Fargo-expose the plan to kick-start a secured-bond marketplace for domestic lenders. If such as for instance a market ‘s the substitute for mortgage lenders’ financial support need is still around viewed. However, safeguarded securities possess that ability that ought to cause them to become an improvement along side mortgage-recognized bonds in earlier times provided of the individual associations. Securitized mortgage loans just weren’t supported by the administrative centre of one’s loans’ originators facing loss, however, secured securities are.

Securitization: Exactly what Went Wrong

Whenever a bank tends to make a mortgage loan and you will has actually it into their equilibrium sheet, government need to have the financial to invest in at the least four dollars off all the money of this financing toward bank’s very own money. This criteria means that the college maintains a support up against unanticipated losses, securing the lending company, its people, while the department that makes sure the new bank’s dumps. At the same time, whenever a bank securitizes financing, its permitted to remove the financing from the balance piece, eliminating this new pillow requirement and you can releasing the lending company to use new investment to other purposes. Latest sense has revealed that when you are finance might have been eliminated on the balance piece from the securitization processes, all relevant dangers were not. We have found that, really, the process moved financing out-of a seriously controlled, well-tracked, and generally realized stadium to your one in which dangers have been tough to shade or assess.

The root threats behind extremely securitized mortgage loans was blurry by the their difficulty in addition to number of parties involved in their packaging. The new securitization procedure begins with the fresh underwriter (a good investment lender, Freddie, or Fannie), whom instructions mortgages out-of some lenders and then transmits ownership to help you a separate-objective entity (a different corporation otherwise providers believe). The latest special-goal entity produces bonds one to depict says towards desire and you may prominent repayments of your pooled mortgage loans.

Leave a Reply

Want to join the discussion?Feel free to contribute!