Financing sort of: Signature loans and you will auto loans normally have highest APRs than mortgage loans

What Has an effect on Apr to your that loan?

When searching for private, college student, otherwise mortgage loans, you can make use of the newest Apr to find the online payday loans Ohio best choice based on your own demands and you will total budget. Yet not, APRs commonly static data; they changes considering some factors, just like your credit rating, earnings, debt-to-money proportion, and you can commission record.

- Credit rating: Every loan things keeps a minimum credit rating specifications to safeguard the lender of an adverse investment. A higher credit score will bring you a lower Apr and base interest rate, decreasing the total cost of the mortgage.

- Income: Your earnings can help determine whether you really can afford financing without provided other variables just like your debt. Charge card APRs generally speaking try not to cause for your financial situation.

- Debt-to-money (DTI) ratio: For mortgage loans, the Annual percentage rate might be dependent on your own DTI proportion, hence says to loan providers whether you really can afford to settle the borrowed funds because of the researching the money you owe into the income. Typically, loan providers want to see an excellent DTI out of 41% or lower, which means that merely 41% of gross income goes towards the expenses personal debt like credit cards and you may funds.

- Fee record: Your own creditworthiness also can influence their annual percentage rate. Lenders will note that borrowers provides a history of investing the expenses punctually and also in full every month.

- Advance payment: Having mortgages, while making a high advance payment may cause a lesser Apr since it mode borrowing shorter regarding a lender. The typical down payment for the property is about thirteen%, but some financing require 20% right down to avoid private financial insurance (PMI). One another MIP and PMI may have an enormous influence on Annual percentage rate.

In addition, APRs are influenced by exterior facts the fresh debtor does not have any control more than, particularly sector criteria while the loan type.

But not, it isn’t really correct and largely depends on the borrowed funds equipment. Although not, generally, bank card APRs are much greater than mortgage APRs, this is exactly why of several property owners always re-finance their houses so you’re able to pay back debts. In addition, Virtual assistant fund enjoys all the way down APRs and you can interest levels than simply antique money once the you will find a limit about much a lender may charge you inside the costs.

Loan terms and conditions: Prior to, we chatted about just how 30-year mortgages typically have large APRs than simply fifteen-season mortgages. It is because offered financing words mean using much more within the desire along the longevity of the loan.

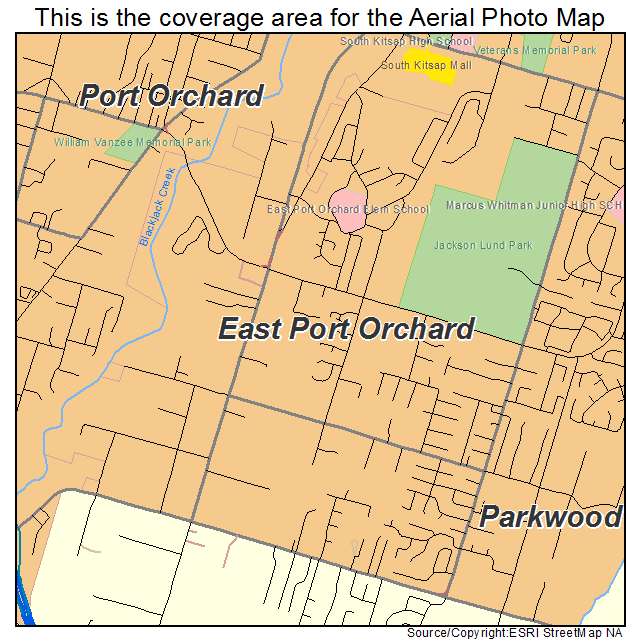

Location: Home loan rates and you can APYs are generally determined by the location of the home. By way of example, also municipalities enjoys various other assets tax number that will result in higher or lower APYs for the very same real mortgage.

Repaired vs Adjustable Apr

There are two version of APRs to consider whenever seeking a loan: repaired and you will changeable. The difference between both can impact the entire value of your loan, very choosing which one is the best for you is of your maximum characteristics.

Changeable Apr

Adjustable APRs vary based on sector standards and certainly will start straight down inside initial title. Such APRs are typically with the variable-price mortgage loans (ARMs), house equity personal lines of credit (HELOCs), signature loans, handmade cards, and you may college loans.

Adjustable-rates mortgages will have a varying Annual percentage rate and you may rate of interest, but other types of money and you may personal lines of credit may also features fixed APRs; they sooner depends on the loan otherwise bank card, standard bank, also situations.

Variable APRs is actually ideal when you wish to blow quicker to have the initial name from a loan because the rates of interest are generally less than fixed-price finance. But not, if rates of interest increase, your loan payments increase. A lot of people buy a house that have an adjustable-rates financial and you will re-finance they till the introductory period ends up to help you have the best rates.

Leave a Reply

Want to join the discussion?Feel free to contribute!