Domestic Security Lending: Opportunity, Prerequisite otherwise Distraction?

Financial lenders are continually worried about new products to increase an excellent competitive boundary. This will be usually done to take advantage of the typical ebbs and you can circulates of interest cost otherwise casing interest. But the unmatched develops inside rates into the 2022 and towards 2023, combined with homes speed expands in the last long time, has actually set a look closely at domestic collateral financing – credit lines (HELOCs) and you can signed-stop family collateral financing – as required products in a weird, remarkable means.

There is absolutely no question that key things getting mortgage businesses and you will finance companies at this time are those that may allow an income so you’re able to at least breakeven functions. Nevertheless environment has the benefit of an opportunity to revisit a lot of time-title wants.

In this post, we’re going to discuss industry views toward domestic guarantee lending industry and you will strongly recommend you’ll be able to tricks for mortgage brokers given how-to apply of the current unique sector disease.

Industry

The level of home guarantee readily available because guarantee for house collateral secured credit has grown within a-sudden pace. Studies by CoreLogic shows U.S. homeowners with mortgages (approximately 63% of all of the features for every single the newest Census Bureau’s 2016 Western People Questionnaire) have observed its equity raise from the a total of $step 1 trillion once the 4th one-fourth out-of 2021, an increase regarding 7.3% 12 months-over-seasons. According to Black Knight, tappable family equity has grown because of the $step three.4 trillion over the last 36 months.

It trend stopped somewhat from the finally months regarding 2022. Since the house speed increases shown a reduced, regular lowering of really markets, family collateral style obviously then followed suit. Regarding the fourth one-fourth off 2022, the typical borrower achieved on the $fourteen,3 hundred into the equity 12 months-over-season, in contrast to the new $63,100 boost seen in the original one-fourth out of 2022. However, the degree of lendable household collateral stays extremely high.

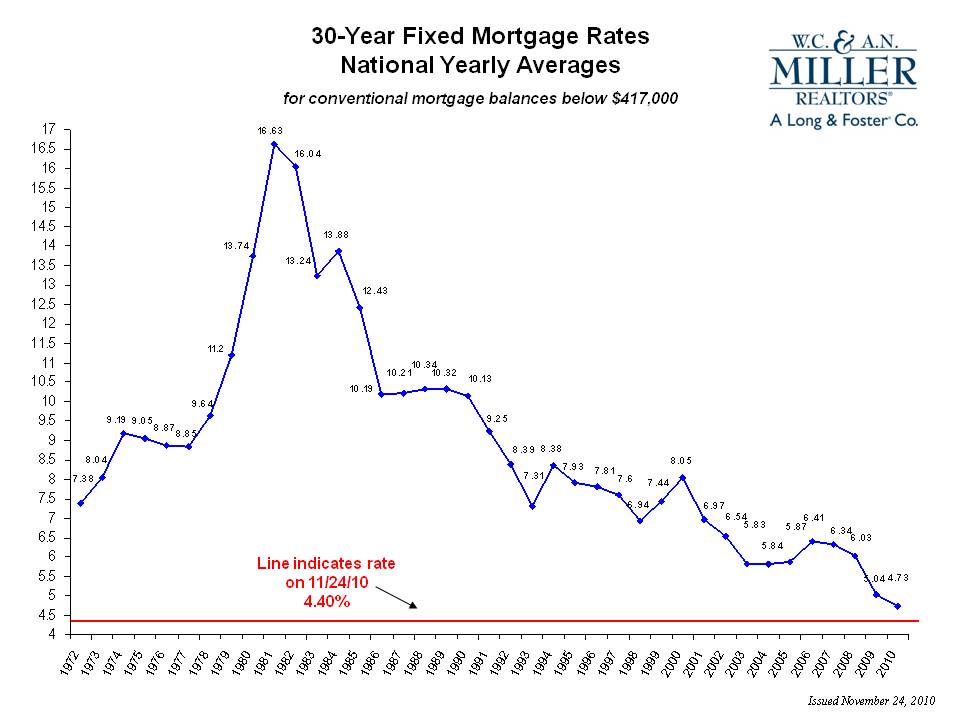

The necessity for home equity financing and outlines now is high. Individuals are efficiently frozen positioned with respect to the current mortgages. Centered on Black Knight, approximately 80% of an excellent mortgage loans have a installment loans for bad credit Hudson rate from cuatro.5% or smaller, given that revealed during the Graph step 1 less than, playing with investigation as of :

Inside current environment, mortgage borrowers who wish to see bucks utilising the collateral of its appreciated characteristics are gonna think a home collateral loan or credit line rather than a cash-aside refinance, especially for individuals with rates lower than three percent. To possess a debtor with a preexisting $300,000 loan for a price off step 3.0%, replacement a loan these days at the 6.5% and you can incorporating $thirty five,000 for cash away do result in a general change in percentage, whenever a 30-year amortization, out-of $step 1,265 in order to $dos,117, or an $852 improve. That same $35,000 raise financed using a home equity line of credit, that have a frequent ten-12 months notice-just construction, do bring about a supplementary payment regarding merely $277/times for a price from 9.5% (prime along with step 1.5% today). Attaining the need bucks impact utilising the household equity range was persuasive.

Family Security Loan Origination Styles

Quantities regarding family collateral financing and personal lines of credit rose substantially inside 2022 as compared to 2021. Predicated on Curinos, the rise during the devices are as much as 53% season-over-season. Considering the large amount of offered house collateral, it could see analytical for this development development to own proceeded with the 2023. Contrary to popular belief, that isn’t the outcome. Chart dos reveals the fresh new loan booking growth in very early 2023 opposed towards the exact same several months during the 2022 illustrating a fall in originations in the 1st 3 months of the year when you look at the Graph step 3.

At the same time, credit debt continues to speed. The private finance webpages Purse Center accounts that credit debt enhanced by the accurate documentation $180 million in 2022 which have mediocre pricing approaching 21%. Even though the grows from inside the credit card debt is highest from inside the younger age range, there have been increases across the market spectrum.

Leave a Reply

Want to join the discussion?Feel free to contribute!